Summary: Equalization Payments 101

In Canada, the federal government makes equalization payments to provincial governments to help address fiscal disparities amongst the Canadian provinces based on estimates of the provinces’ fiscal capacity, which means the respective provinces ability to generate tax revenue.

Do All Provinces Receive These Payments?

All of the provinces do not receive equalization payments as fiscal capacity varies province-by-province. A province that does not receive equalization payments is often referred to as a “have province”, while one that does is called a “have not province”.

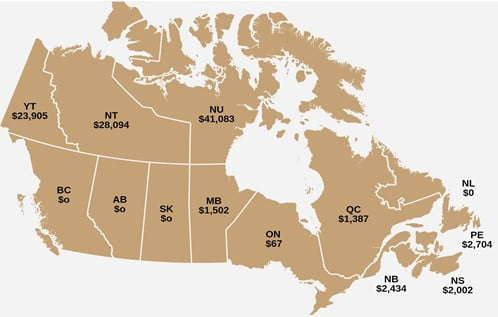

Specifically in 2020-21, five provinces received $20.573 billion in equalization payments from the federal government – Quebec, Manitoba, Nova Scotia, New Brunswick and Prince Edward Island. The “have provinces” for 2020-21 that are not receiving equalization payments includes Ontario, Alberta, British Columbia, Saskatchewan and Newfoundland and Labrador.

Notably, the territories are not included in the equalization program, as federal funding for the territories is provided through the Territorial Formula Financing (TFF) program.

Here is a chart of historical equalization payments from 1957 to 2018 and the payments for 2020-21:

How Are Equalization Payments Calculated?

The fiscal capacity of provinces is measured using a representative tax system – a basic model of provincial and municipal tax systems – covering virtually all own-source provincial revenues (own-source provincial revenues means provincial taxes, such as retail sales tax, income tax, etc.). It is made up of estimates of provincial tax bases, actual provincial revenues and population. By using the same tax base definition across all provinces, the representative tax system can be used to compare the ability of individual provinces to raise revenues. The “have provinces” are those that generate more tax revenue per person than the national average, while the “have-not provinces” have revenue per person below the national average.

The individual revenue sources are grouped into five categories:

- personal income taxes;

- business income taxes;

- consumption taxes;

- up to 50 percent of natural resource revenue; and

- property taxes and miscellaneous.

Each revenue category has a separate tax base and each province is allocated an “equalization entitlement” equal to the amount by which its fiscal capacity is below the average fiscal capacity of all provinces. This is known as the “10-province standard”, which results in our “have provinces” and our “have not provinces”. The final payments are then determined based on the provinces’ relation to this average.

The payments are typically adjusted to ensure fairness between the provinces and are designed to provide a net fiscal benefit to receiving provinces from their resources equivalent to half of their per-capita resource revenues. Equalization payments are further adjusted to ensure the program aligns with the overall growth of the Canadian economy (based on a three-year moving average of GDP). It is important to remember that equalization payments are separate and distinct from other transfer payments from the federal government to provincial governments, which includes the Canada Social Transfer and the Canada Health Transfer.