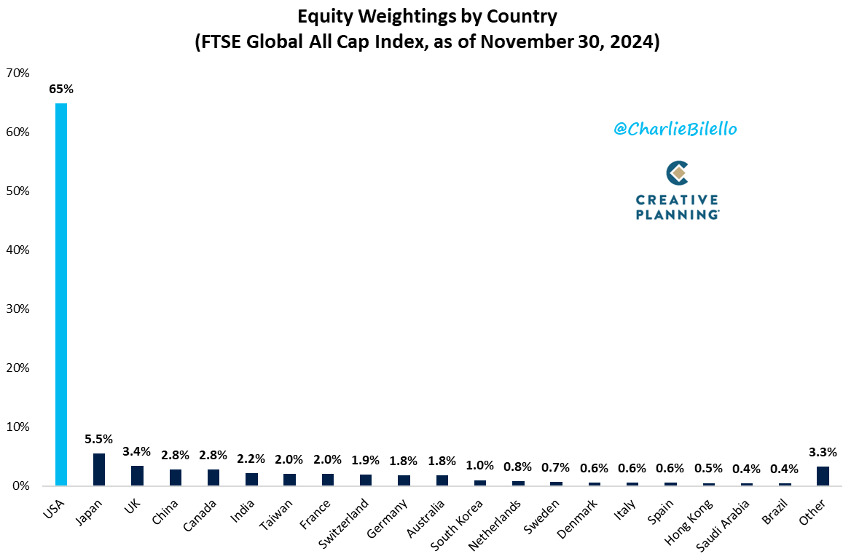

This is one of my favourite charts on the internet:

Even adjusted for population size and GDP, the US stock market is massive. There are some good reasons for this: the biggest companies in the world, despite earning revenues internationally, are listed on US exchanges. Americans are also much more likely to invest in equities than Europeans. This is likely influenced by housing affordability, as the US ranks favourably compared to other developed nations in terms of both housing price to income ratio and mortgage as a percentage of income. More affordable housing means more dollars available for investment accounts.

And let’s not forget that the US is coming off of a period of massive outperformance over the last decade and a half which has skewed global stock market weighting more heavily in its favour.

Does a strong domestic stock market help the Canadian economy?

The stock market has a well-documented psychological impact on the population, the aptly named Wealth Effect. When the stock market is rising, individuals feel wealthier, so even if they aren’t selling their appreciated stocks to fund consumption, they are more likely to spend more to reflect their rising net worth. Consumer sentiment is influenced by recent stock performance, even if consumer sentiment is demonstrably inversely related to go-forward returns. More money in circulation in the economy means stronger corporate bottom lines and more tax revenue.

On a tangible level, stocks are a store of value and they can be borrowed against, just like the equity in a home. A rising market means more valuable assets that can be used as loan collateral, with loan proceeds that can theoretically be used to further stimulate the economy.

In short, a rising stock market has positive implications for the Canadian economy.

So should I be buying Canadian stocks to help the economy?

The stock market functions based on price discovery: investors reward companies that are deploying resources effectively by bidding up their share prices; they punish companies that misallocate capital by directing investment dollars away. By allocating resources toward more productive uses, investors serve a role in driving economic progress. Price discovery isn’t a perfect exercise, but the stock market is, in theory, a meritocracy.

Some feel that competing priorities should supersede the role that the stock market plays as an efficient allocator of capital. A Globe and Mail article argued that Canadian pensions are doing their country a disservice by not owning more Canadian equities. CPP drew particular ire, as just 11% of its assets are held in Canadian stocks, versus 41% invested in the United States.

I can’t get behind this take. The retirement of millions of Canadians hinges on the CPP’s ability to deliver investment returns. A patriotic investment strategy would be cold comfort to beneficiaries if entitlements were cut. Besides, an 11% Canadian weighting represents a significant overweight considering Canada’s share of global market cap (and 41% in US equities is an underweight).

It’s a bit like Canadian content requirements on TV and radio, except the stakes are a lot higher than listening to too much Drake and Justin Bieber.

The driving force behind the wealth effect is stock ownership; the geography of origin of the constituent companies isn’t relevant. The big push, therefore, shouldn’t be for investors to hold more of their assets in Canadian stocks; it should be for individuals to invest more in stocks, some of which should be Canadian. The stock market is the greatest wealth creation machine in world history. Instead of arguing over how the pie is divided, we should be focusing on making it bigger.

If you enjoyed this article and want to read more from the “Investing” section of our site, click here!

Opinions are those of the author and may not reflect those of BMO Private Investment Counsel Inc., and are not intended to provide investment, tax, accounting or legal advice. The information and opinions contained herein have been compiled from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the author nor BMO Private Investment Counsel Inc. shall be liable for any errors, omissions or delays in content, or for any actions taken in reliance. BMO Private Investment Counsel Inc. is a wholly-owned subsidiary of Bank of Montreal.