Summary: Prioritize the Big Things in Life

If you ever took Introduction to Philosophy as an elective in university, you may be aware of the golf balls in a jar lesson. This is the quintessential lesson highlighting the importance of focusing on the big things in life. The professor presents to the students a mason jar and begins filling it with golf balls, one by one. When the golf balls are right up to the brim, she asks the room full of students if the jar is full and they all agree that it is. She then begins adding sand to the jar. When the sand reaches the top of the jar, she once again asks her students to concur that the jar is full. She then opens a bottle of beer, and empties the entire contents into the jar. Not a drop spills over the rim.

The professor then completes the experiment again, but this time in reverse order: she pours a bottle of beer into the jar, and then adds the sand, and finally begins adding golf balls. This time, she isn’t able to add as many golf balls. The implication for her students is clear: prioritize the big things in life and let the little things fill in the cracks. If you waste your time on the little things, then the big things don’t fit.

Big Picture Budgeting

Contrary to the advice put forth by some of the most renowned individuals in personal finance (both Suze Orman and Dave Ramsey are on record as saying that buying lattes is a waste of money), I feel that this “focus on the big things” message applies to budgeting as well. Take housing, for example. One of the golden rules of personal finance is that you shouldn’t spend more than 25-30% of your gross (pre-tax) income on housing. The average income for Canadians between ages 25 and 54 was $58,400 in 2020. If housing costs are 30% of gross income, then the average Canadian in the core working demographic would be spending about $17,500 on a place to live. Vehicles are another major expense category, and costs have only climbed over time with the rise in popularity of trucks and SUVs over sedans. Car payments alone cost between $300 and $600 per month. When fuel, maintenance, and car insurance are added in, the total cost of keeping a vehicle on the road can be close to $10,000 per year. More on car ownership here and home ownership here.

Now imagine that your vice is coffee. Every day at around 10:00 a.m., you get up from your desk and walk to Starbucks for a $5 latte. Assuming 250 working days and a coffee every day, your total annual coffee expense is $1,250. Not exactly cheap, but assuming you get enjoyment from your daily coffee walk, it may very well be worth it. Saving $1,250 would necessitate a 100% reduction in your coffee budget. If you are an average Canadian with an income of $58,400 spending $17,500 on housing, the same $1,250 could be saved by reducing what you spend on housing by 7%.

The point is not to think of personal finance in terms of trade-offs between housing and coffee, but rather to show that more radical budget adjustments should be done from a top-down rather than bottom-up approach. Discretionary purchases should be reviewed (because they are, by definition, discretionary), but it’s easier to find larger opportunities to save when you’re looking at expenses that make up most of your budget. Vehicles are a glaring example of this, because they are a want masquerading as a need. Can $10,000 in vehicle expenses be reduced to $2,000 in transportation expenses from a combination of public transit and strategic Uber rides?

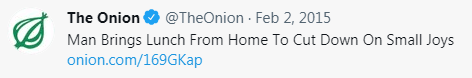

I often think about this tweet from satirical news site The Onion:

There is more to personal finance than cutting back on everything that makes life worth living. Make sure all of your golf balls fit in the mason jar before you start focusing on grains of sand.

Opinions are those of the author and may not reflect those of BMO Private Investment Counsel Inc., and are not intended to provide investment, tax, accounting or legal advice. The information and opinions contained herein have been compiled from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the author nor BMO Private Investment Counsel Inc. shall be liable for any errors, omissions or delays in content, or for any actions taken in reliance. BMO Private Investment Counsel Inc. is a wholly-owned subsidiary of Bank of Montreal.