Summary

Deciding on asset mix is the primary concern when building an investment portfolio. There’s good reason for this: your asset allocation (which refers to the breakdown of your holdings between equities, fixed income, real estate, and other alternative investments) will have a tremendous impact on your long-term returns. However, when it comes to retirement planning, asset location (the selection of which types of accounts to invest within) can be as impactful as your overall asset mix. RRSPs and TFSAs are tax-advantaged investment accounts available to all Canadians and their benefits are widely known. Individual Pension Plans are not as commonly discussed, as they are available to only a subset of the working population, but when employed correctly they can lead to significant tax savings and more funds available in retirement.

How do Individual Pension Plans Work?

Individual Pension Plans (IPPs) are designed to serve the same function as standard pension plans offered by employers: providing an income in retirement. They are therefore ideal for business owners and incorporated professionals who may not otherwise have access to a pension plan through work. Just like with RRSPs, contributions to IPPs are tax-deductible, meaning they are not considered to be income from the perspective of the CRA. For example, if an incorporated doctor were to make a $25,000 contribution to her IPP from her corporation, she would pay no income tax on the amount of the contribution. Upon retirement, the owner can draw funds from the IPP directly, or the funds can be transferred to a locked-in retirement account (a LIRA or LIF), or used to purchase an annuity. Just like with RRSPs, dividends, interest, and capital gains are not taxed within the IPP, but any withdrawals are taxed as income. Contributions to an IPP cannot be withdrawn for any reason other than the payment of benefits in retirement.

It’s important to note that contributions to an IPP count against RRSP contribution room in the same way that employer-sponsored pension plans do.

What are the Advantages?

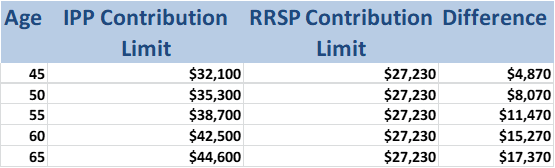

The primary benefit of IPPs is higher contribution limits. At age 40, contribution limits are roughly the same between RRSPs and IPPs so there is no relative benefit to investing in an IPP. Beyond age 40, however, the difference between the maximum contribution to an IPP and an RRSP grows:

Higher contributions have two benefits: more opportunity for tax deferred growth and lower taxable earnings in peak earning years.

As all contributions to either IPPs or RRSPs are tax-deductible, higher contributions lead to greater tax savings. To highlight the impact of investing with an IPP, imagine a hypothetical situation where a 45-year-old incorporated lawyer living in Manitoba is trying to decide whether she should invest in her RRSP or establish an IPP. She is a high income earner and her maximum RRSP contribution limit is $27,230. She is in Manitoba’s top marginal tax rate of 50.4%. She has no income tax owing, so any contributions will lead to a tax refund. For the sake of simplicity, we will assume she has $32,100 in funds available to invest, exactly the IPP contribution limit for her age. If she chooses to contribute to an RRSP, she will receive a tax refund of $13,724 ($27,230 multiplied by her marginal tax bracket of 50.4%) which she can invest in a non-registered account. Combined with the $4,870 she had left over after making his RRSP contribution, she will have a total of $27,230 invested in an RRSP and $18,594 invested in a non-registered account. If instead she had chosen to establish an IPP, she could make a contribution of $32,100 from the corporation and receive a refund of $16,178 ($32,100 multiplied by 50.4%) to invest in a non-registered account. By using an IPP, she would have $48,278 in total investments instead of $45,824 if she had instead invested in an RRSP. Without taking on any additional investment risk, she has earned herself $2,454 in surplus returns.

Setting up an Individual Pension Plan

IPPs are designed to function as defined benefit pension plans, meaning the benefits that the plan member receives are determined in advance. For this reason, an actuary must be engaged to establish the plan and certify that the contributions made to the IPP are adequate to fund the benefits promised to the plan member. An actuarial formula is used to determine the necessary amount of the contribution based on the plan member’s T4 employment earnings. The contribution formula assumes an annual return of 7.5% on investments held in the IPP. Given this funding obligation, IPPs also have a top-up provision that isn’t present with RRSPs: if the investments fail to achieve a return of 7.5%, additional contributions can be made to the plan to bring it to this fully funded status. These additional contributions are also tax-deductible. Additionally, the costs associated with establishing and maintaining an IPP (including investment fees) are tax deductible to the company.

IPPs are a complex and nuanced investment vehicle and this is just a brief overview of the benefits and structure. If you meet the criteria that would make an IPP applicable for you now or in the future, then speak to your advisor about next steps. It’s never too early to start planning for retirement.

Opinions are those of the author and may not reflect those of BMO Private Investment Counsel Inc., and are not intended to provide investment, tax, accounting or legal advice. The information and opinions contained herein have been compiled from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the author nor BMO Private Investment Counsel Inc. shall be liable for any errors, omissions or delays in content, or for any actions taken in reliance. BMO Private Investment Counsel Inc. is a wholly-owned subsidiary of Bank of Montreal.