Summary: How to Purchase a Home as the Market Changes

Over the past 18 months, the Canadian Real Estate market has changed, with inventory being low, interest rates at an all-time low & home buyer’s savings higher than ever due to the pandemic restricting entertainment/travelling spending. Agents have been stating since the middle of 2020 that there has never been a better time to sell, but somehow the market continued to appreciate. Given this tumultuous market, many potential buyers are likely thinking long and hard about how to purchase a home right now.

As a licensed REALTOR ® within Winnipeg’s market, this article will focus on the numbers in the Winnipeg market. In May 2020, the average detached single family home price was $340,085. Compare that to April 2022, the average detached single family home price is $456,221. With changes this substantial within our housing market, buyer’s and their agent must continue to re-evaluate their buying approach and strategies or opportunities will pass you by. In this article, I will detail some of the strategies I’ve used to assist buyers to successfully purchase a home & provide buyer’s with more knowledge on where our market is, and where it is heading.

Home Buying Conditions/Deposit/Possession

As inventory has been at an all-time low, home buyers know that offers dates have been ultra-competitive. In order to ensure your offer has the best chance to be selected, you must complete your home inspection due diligence during your showing(s) prior to writing, so that you are comfortable waiving this condition when submitting an offer. The same goes for financing. Clients & their agents should review sold comparables within the area within the past 3-4 months and decide on a max offer price. After doing this, be sure to discuss this with your mortgage professional & submit the MLS listing to them, so that you have a vote of confidence that you can qualify for the loan and that the appraisal cannot come in lower than the loan you will have for that property. Having a large deposit such as $10,000 or $20,000 will provide the seller’s with additional security that in fact, you as the buyer(s) will close come possession date. The larger the deposit, the less likely it is that a buyer will walk away from a home after the offer is accepted (this depends on the size of your down payment. Each buyer’s down payment may be different. I encourage you to speak to your mortgage professional and agent on this). Lastly, knowing the desired possession date of the seller is important as they likely have a closing date on their newly purchased home that they are moving into, which you as a buyer must try to accommodate, in order to make your offer as attractive as possible.

Agents Involvement & Establishing a Relationship between Buyers/Sellers

When you select your buyer’s agent, you should feel that they are doing everything within their means to try and find you a home. This includes communication between you, your home inspector, mortgage professional and the listing agent(s), knowledge on the submarkets recent sales, knowledge on a home’s structure, systems, mechanicals & chattels and the overall ability to ease the stress of the home buying process. As a buyer’s agent, communication with the listing agent is vital and having a reputation of qualified buyer clients can strengthen your odds of receiving a counter offer or acceptance within a multiple offer situation and this is another reason why preparation in making your offer as attractive as possible is very important. Ultimately, the highest offer will likely win, but in some cases it does not. Sellers have the freedom to select or counter whichever offer they’d like. I strongly encourage buyers to ask their agents to try and develop a connection with the listing agent to try to understand the seller’s situation. If it turns out that this was the first home that the sellers had purchased, and you are a first time buyer, maybe a hand-written letter and photos of you/your family can provide you with a slight edge vs. the competition. On the other hand, if it is an estate sale, for example, there may be multiple executors, which means that the total purchase price will likely be the deciding factor.

Our Current Market

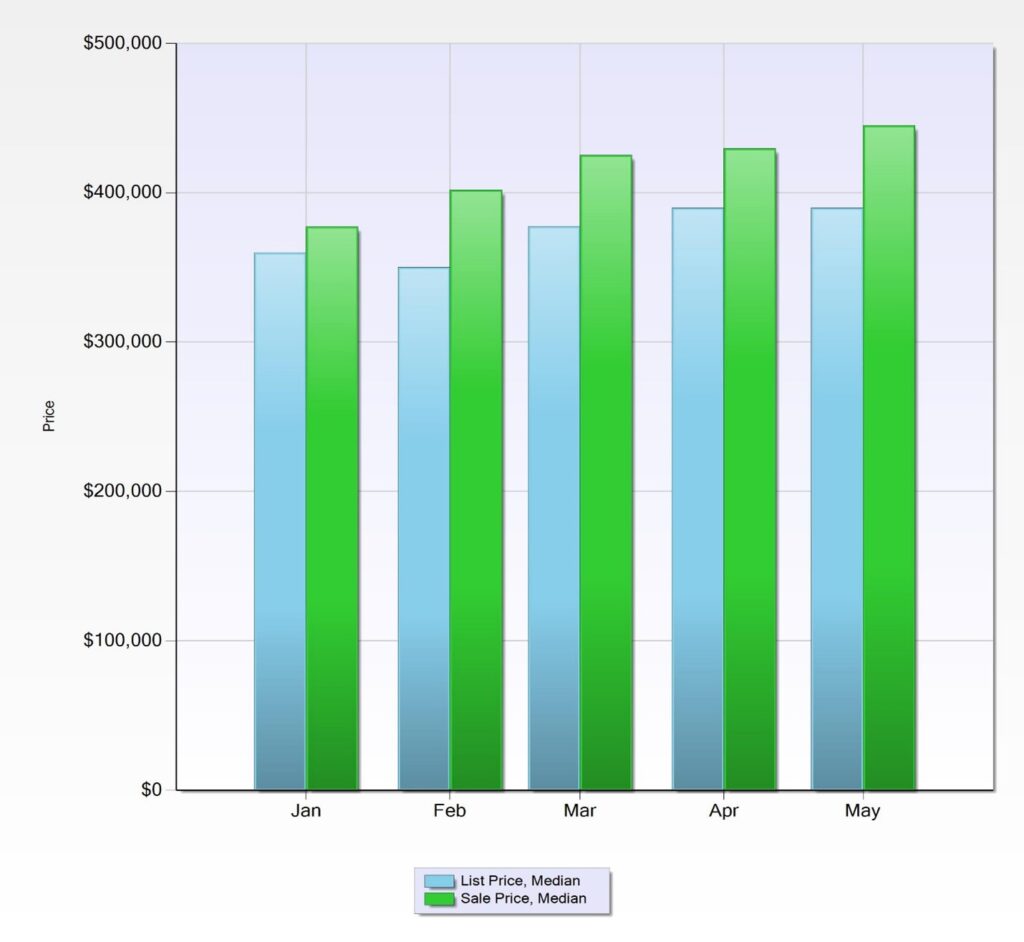

With the previous interest rate announcement, the current increase of inventory in 2022 & the decrease of $46,000 amongst average sale prices in the Greater Toronto Area, there is some chatter that our real estate market in Winnipeg will decrease sooner than later. Though there may be some merit to this claim, the chart below shows the median list price vs the median sale price for detached single family homes within Winnipeg in 2022:

The difference between the median list price vs. median sale price in May 2022 is $55,100. The second closest gap is February 2022, which was $52,107. People may ask, how is this possible as rates continue to rise? It is important to understand most lenders provide pre-approvals which are valid for an average of 90-120 days or more. Therefore when we look at the scheduled dates of The Bank of Canada’s rate announcements, we can see the spikes.

After today’s announcement, the remaining scheduled dates for the interest rate announcements for 2022 are as follows:

- Wednesday, July 13, 2022*

- Wednesday, September 7, 2022

- Wednesday, October 26, 2022*

- Wednesday, December 7, 2022

*Monetary Policy Report published

These rate announcements are creating urgency for buyers to purchase a home sooner rather than later to buy their interest rate, in turn saving them interest for their 5 year mortgage contract. The combination of higher interest rates and more inventory has forced listing agents to have conversations with their seller’s if they should price low and aim for a the records sale prices, or price conservatively, therefore reducing the risk of having an unsuccessful offers date, and increasing the asking price afterwards to what their expectations were.

Now this is not the case within each submarket of Winnipeg, therefore I recommend having conversations with your Realtor regarding recent list price vs. sale prices within submarkets of Winnipeg and those homes interior/exterior finishes before writing offers to better prepare you for when you submit an offer. The market is changing constantly, which means that agents, buyers and sellers need to adapt as well.

There was a lot to unpack within this article, so if you are looking to buy or sell within and around Winnipeg and have not selected an agent to represent you, or have any further questions about how to purchase a home, please feel free to contact me today.

For more great real estate related content and insights from David, please visit his Modern Money article profile here.