What is a RRIF?

From ages 18 to 71, all Canadians earning an income are able to save money in an Registered Retirement Savings Plan (RRSP). The amount that can be contributed is dependent on income and more details can be found here. RRSP contributions are tax-deductible, meaning that all contributions up to the individual’s contribution limit reduce taxable income. For example, if Stacey is earning $100,000 a year and she makes a $20,000 RRSP contribution, in the eyes of the CRA her taxable income is only $80,000 and her income tax bill will be lowered accordingly. Think of RRIFs as the next evolution of the RRSP.

Beyond being tax-deductible, RRSP contributions are also able to grow tax-free as they aren’t subject to tax on capital gains, dividends, or interest. The goal of an RRSP, as the name implies, is to provide a tax-efficient vehicle to encourage Canadians to save for retirement. However, the CRA eventually wants to be able to collect tax on all the funds that have accumulated in your RRSP, so by age 71 it must be converted to a RRIF (Registered Retirement Income Fund). Think of a RRIF as the butterfly that emerges from the cocoon that is an RRSP.

How RRIFs Works

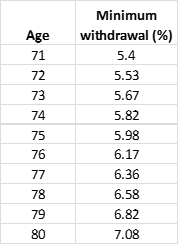

All RRSP holders must convert their accounts to RRIFs by age 71, but they have the option to do so sooner if they choose. The RRSP is meant for accumulating savings; the RRIF is intended to provide income. All RRIF holders are subject to a minimum annual withdrawal from their account every year depending on age:

The minimum is the above percentage multiplied by the account value as of December 31 of the previous year. For example, if you turned 75 in 2022 and your account was worth $1,000,000 as of December 31, 2021, your minimum withdrawal would be $1,000,000 x 5.98% = $59,800. The age column indicates the year in which you reach that age. It is important to remember that all investment growth (interest, dividends, and capital gains) continues to be tax-free within a RRIF.

Why Do I have to Take Out Money?

The government wants to make up for all of those income tax deductions that you got from contributing to your RRSP. Just like contributions to an RRSP are tax-deductible, withdrawals from a RRIF (or RRSP) are taxed as ordinary income. If you take $20,000 from your RRIF, that money will be taxed just as if you had earned it working at a job.

Further, RRSPs and RRIFs are deemed to be deregistered when the account holder dies. From the perspective of the CRA, the account is collapsed on the day of death and the entire balance is taxed as income. If an individual with a $200,000 RRIF and no other income were to die, then the entire balance of the RRIF would be taxed as ordinary income in the year of death. The exception is when the account holder has a surviving spouse; in this case, the account will be transferred to the surviving spouse in-kind.

Are RRIFs Worthwhile to Use?

The mechanics surrounding RRSPs and RRIFs have all sounded pretty negative so far, but they are an effective vehicle to save for and fund retirement. As noted, all investment growth within these accounts is tax-free. Since your interest, dividends, and capital gains aren’t being taxed, more money remains in your investment portfolio for compound growth. This also allows you to sell investments without having to worry about the tax impact.

RRSPs and RRIFs are tax-deferred accounts, meaning you can shift the tax burden from your prime earning years to your retirement years when your income won’t be as high. Even though withdrawals are taxed as income, shifting your earnings in this way can present significant tax savings. The top combined tax rate in Manitoba is 50.4%, so an individual contributing $20,000 to her RRSP would save $20,000 x 50.4% = $10,080 in tax. If she makes a subsequent $20,000 withdrawal from her RRIF when her marginal tax rate is 37.9%, she will pay $20,000 x 37.9% = $7,580 in tax. Just by shifting the income from her prime earning years to her retirement years, she will save $2,500 in taxes. This is before accounting for the benefits of tax-deferred growth.

RRIFs may not seem very important to young investors. Who cares about an account that you won’t have to use until you’re 71? Just remember that we will all (hopefully) get old one day and your future self will thank you for taking the time to plan for your retirement!

Opinions are those of the author and may not reflect those of BMO Private Investment Counsel Inc., and are not intended to provide investment, tax, accounting or legal advice. The information and opinions contained herein have been compiled from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the author nor BMO Private Investment Counsel Inc. shall be liable for any errors, omissions or delays in content, or for any actions taken in reliance. BMO Private Investment Counsel Inc. is a wholly-owned subsidiary of Bank of Montreal.