Summary: What is Fixed Income?

Fixed income refers to investments, such as bonds, that provide regular interest payments over time and return the principal at maturity. These investments are known for their stability, lower risk compared to equities, and ability to reduce overall portfolio volatility. Fixed income plays a key role in a balanced portfolio, offering predictable income and acting as a safeguard during market downturns.

Understanding Fixed Income Portfolios

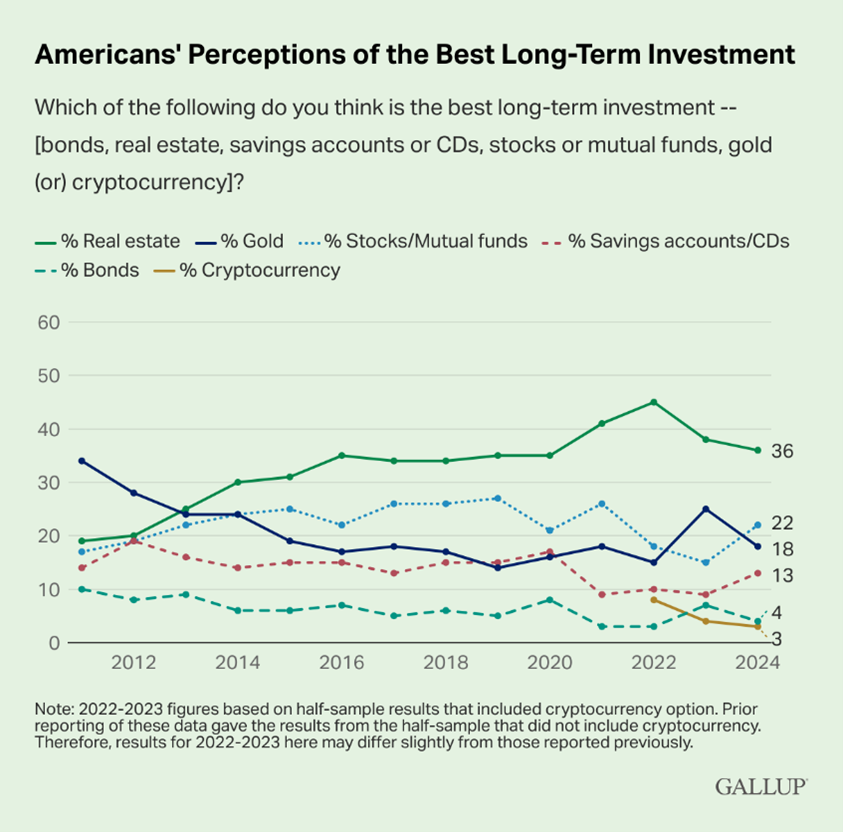

There are two investment classes that I feel get more love than they deserve: (1) Real Estate; and (2) Gold.

The data supports the idea that they are fondly regarded by investors:

There are a few reasons why I believe that this is the case. The illiquidity of real estate means homeowners don’t see the day-to-day fluctuation in prices like they would in the highly-liquid stock market, so volatility can be ignored. Real estate and gold also benefit from their tangibility: direct ownership over a parcel of land and the structures that occupy it, or even a piece of yellow metal, is much easier to grasp than an equity position in a multinational conglomerate. Real estate also provides a semblance of control: prices are subject to economic cycles and demographic shifts, but we at least have some influence over the value of the real estate we own.

Many also simply believe that the fix is in when it comes to the capital markets, and they’d rather place money in assets that are not swayed by corporate misgivings, price manipulation, or abuse of political power (which has also contributed to the rise of crypto). This is supported by fatalistic worldviews, which imply that even though the stock market has done an incredible job of compounding wealth over a period of more than a century, things have fundamentally changed in some form or another and it will not continue to deliver strong returns.

To be charitable, the framing of the question probably goes a long way toward influencing how it was answered. “Best long-term investment” can be interpreted in a lot of different ways. What exactly is long-term? How is “best” defined; does it just mean highest overall return, or is volatility accounted for?

Regardless, it’s not the kind of chart where I would expect bonds to rank very highly. Bonds have two strikes against them: they trail equities when it comes to long-run returns, but they are always highly liquid and therefore exhibit volatility, unlike real estate.

Building a Balanced Investment Portfolio

When it comes to building an investment portfolio, the two traditional major asset classes are equities and bonds, yet only 1 in 4 Americans polled believed that either of these asset classes would be the strongest long-term investment (my choice would be equities and there’s no close second).

I’ll confess that I’d be quite surprised if bonds do end up being the best performing long-term investment, but I believe strongly in their role in portfolio construction.

For one, bonds provide a predictable source of income. The income portion of an investment’s return is much more predictable than capital appreciation. With a portion of return coming from bond interest income, the overall volatility of an investment portfolio’s returns is reduced. The issue with interest income is that it is taxed less favourably than capital gains or dividends, but if bonds are held in a registered account such as an RRSP or a TFSA, then the tax treatment of interest is irrelevant. And unlike dividend-paying stocks, bonds have a defined lifecycle: if they are held to maturity without default, principal will be repaid in whole.

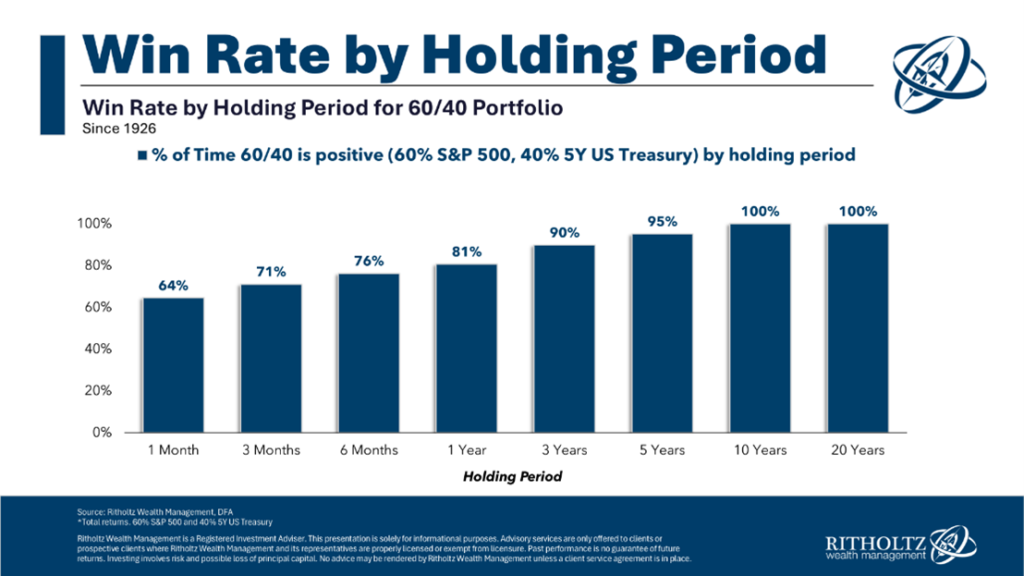

The stock market has delivered the highest long-run return, but its performance may not align with your specific time horizon. Bonds usually exhibit negative correlation to equities precisely when it is needed most: namely, during bear markets. If an investor is in need of cash during a bear market, bonds may be able to fulfill liquidity needs to avoid selling stocks at depressed prices. And when it comes time to rebalance a portfolio, bonds can provide the dry powder used to purchase equities at lower valuations.

The appropriate amount of bonds to hold depends on individual circumstances. Portfolio construction should default to the lower of your willingness and ability to accept risk. For an extremely long-term investor, bonds are likely to generate some drag on performance, but they will also reduce portfolio volatility and increase the likelihood that investment return is positive over shorter timeframes:

If this will prevent you from overreacting and selling at precisely the wrong time, then the bonds in your portfolio are doing their job.

Investing in bonds doesn’t have to be complicated. All-in-one ETFs such as Vanguard’s VBAL or BMO’s ZBAL both provide exposure to both equities and bonds.

Opinions are those of the author and may not reflect those of BMO Private Investment Counsel Inc., and are not intended to provide investment, tax, accounting or legal advice. The information and opinions contained herein have been compiled from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the author nor BMO Private Investment Counsel Inc. shall be liable for any errors, omissions or delays in content, or for any actions taken in reliance. BMO Private Investment Counsel Inc. is a wholly-owned subsidiary of Bank of Montreal.