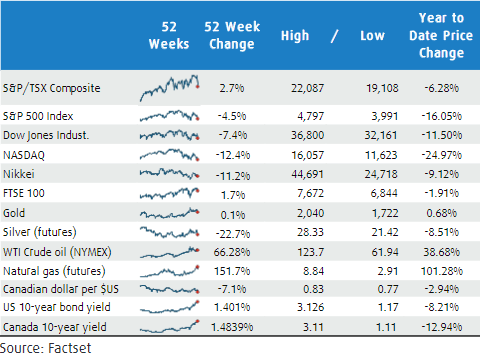

2022 has not been a kind year to financial assets. Many investors have found themselves in the midst of trying to figure out how to navigate a bear market. Here’s a look at year-to-date returns as of May 11th:

The Canadian market was offering a safe haven for investors for quite some time, but it’s now down over 6% in the past couple of weeks. Canadian 10-year bonds are down close to 13% on a price basis as well. Not a pretty picture.

My job is tied to the stock market and every cent that I don’t anticipate spending in the next couple of years is invested in financial assets. Safe to say that I’m all in on the markets. In spite of this, I haven’t lost any sleep over the current pullback. What we are seeing is far from an anomaly – on average, the S&P 500 experiences an intra-year decline of over 15%, a little better than what we’ve seen so far in 2022. When that drop happens at the beginning of the year, it’s a bit more glaring. It’s like a hockey player slumping to start the season instead of 40 games in.

Despite intra-year declines being common, not everyone finds it as easy psychologically learning how to navigate a bear market. Here are a few tips if you’re feeling a sense of panic from falling stock prices.

1. Know what you’re holding and why you’re holding it

In this bear market, and in every bear market that preceded this one, the most speculative of assets are getting hit the hardest.

As I’ve stated previously, I refuse to buy assets that I don’t understand. We’ve seen a lot of people piling in to certain assets just because they had previously gone up in value. Those who bought Dogecoin, Peloton, and Zoom because their prices had risen so explosively are paying for that decision today. You need a more compelling ownership case than simply chasing past returns.

If you can’t make a fundamental case for continuing to own the assets you currently hold, then it may be time to revisit your portfolio construction. One way I do this is by imagining that instead of holding whatever I’m currently invested in, I hold the same dollar amount in cash. Would I spend that cash to purchase exactly what I currently hold?

2. Zoom out to look at the longer timeline

Human beings tend to have a myopic worldview. This is probably why we always think we’re living in unprecedented times. However, it’s definitely not the first time that humans have found themselves trying to figure out how to navigate a bear market. The number of emotional biases that we suffer from during a market pullback could fill the curriculum for a university psychology class. Foremost amongst these biases is anchoring and adjustment: we tend to set our anchor at the high watermark of our investment portfolio and think of any drop from that level as a loss.

When we feel that we have “lost” money, the temptation is often to go to cash to preserve value. This is objectively not a recipe for long-term success.

By definition, the value of cash is eroded by the inflation rate every year. Sure, you avoid volatility, but your spending power is condemned to a slow and painful death. Over any substantial period of time, the markets have proven themselves to hedge against inflation and grow the spending power of your money. The decision between cash and stocks is a decision between a depreciating asset and appreciating assets.

If you are still actively contributing new money, you should appreciate the opportunity that these lower prices present. Lower entry points lead to higher long-run returns. Buying at all-time highs isn’t a great situation for investors with multi-decade time horizons.

The markets don’t win every day but they’ve been proven to win over time. Plan in decades. Execute today.

3. Go bargain hunting.

This only applies to active, DIY investors.

There are some scorned stocks that are currently in massive drawdowns. Shopify, not too long ago the highest market cap company on the TSX, was up more than 11% on May 12th. That brought its cumulative return for the year to…-76%. It is just one in a long list of names that have fallen substantially in 2022. Alphabet is down more than 21%. Meta (formerly Facebook) is down about 44%. Netflix is down 72%.

It’s hard to see it now, but there will be sweetheart deals that come out of this market correction. Amazon fell 95% from December 1999 to October 2001, bottoming out under $6 per share. Even after a 37% drop to start the year, it’s still trading at about $2,139 today. For any DIY investors that were successful in learning how to navigate a bear market in the early 2000’s, in hindsight, investment opportunities such as the 95% decline of Amazon have led to incredible returns over the last 20 years.

Not every company that’s fallen precipitously will bounce back. Do your due diligence when you go looking for stocks on sale. Make sure that you’re buying a broken stock, not a broken company.

Summary: How to navigate a bear market

Above all else, remember that volatility needs to exist in the markets. The only reason that the market can go up over time is because it sometimes goes down. Without short-term risk, there can be no long-term reward.

Opinions are those of the author and may not reflect those of BMO Private Investment Counsel Inc., and are not intended to provide investment, tax, accounting or legal advice. The information and opinions contained herein have been compiled from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the author nor BMO Private Investment Counsel Inc. shall be liable for any errors, omissions or delays in content, or for any actions taken in reliance. BMO Private Investment Counsel Inc. is a wholly-owned subsidiary of Bank of Montreal.