Summary: ESG Investing

As an investor, chances are you have heard the term “ESG investing” in the last few years, but what does it mean? Despite a skewed range of understanding about the topic, the value of assets globally incorporating ESG data into their investment decisions has more than tripled in the last eight years, hitting $40.5 trillion in 2020. However, historically, large institutions (pension funds, endowments, etc.) have held most of these assets, with no way for the average retail investor to participate.

Recently, several ESG products targeting retail investors, such as ETFs, have hit the markets. That said, not all of these products are created equal, and the misleading marketing surrounding them can cause further confusion. In order to successfully navigate this evolving ESG investing landscape, retail investors must understand what exactly ESG investing is, why it’s important and what to avoid to best position themselves for success. For more articles on fundamental investment topics, click here.

What is ESG Investing?

Firstly, ESG stands for Environmental, Social, and Governance. ESG Investing refers to understanding these non-financial elements to better assess potential risks and make more informed investment decisions.

If you’re still unclear about ESG factors, I’ll outline some of the most common examples below. However, it’s essential to note that every industry and investor will have its own key factors.

- Environmental

- Climate change and carbon emissions

- Energy efficiency and waste management

- Deforestation

- Water pollution and scarcity

- Social

- Data protection and privacy

- Gender/diversity

- Community relations

- Safety

- Human rights

- Governance

- Executive compensation

- Bribery and corruption

- Political contributions

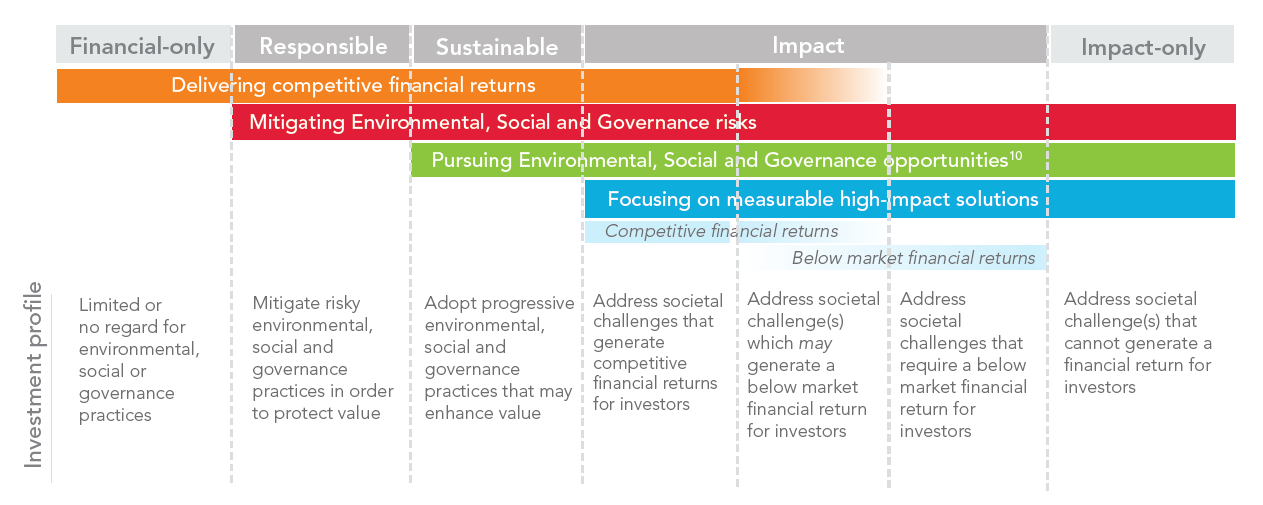

Historically, investors evaluated companies based solely on financially-focused metrics with little concern for more abstract ESG factors. However, since the term ESG was first coined in 2004, increasing significance has been placed on these factors when making investment decisions. The ESG Investing landscape has evolved substantially from an initial concept to an entire spectrum, as shown below.

This spectrum is the primary point of confusion for investors as the terms ‘Responsible, Sustainable, or Impact’ Investing are frequently used interchangeably. Responsible, Sustainable, or Impact Investing all focus on ESG factors, but to varying degrees.

Observe the graphic moving from left to right across the spectrum. As ESG factors take increasingly higher priority over strictly financial returns, we move from traditional Financial-only investing through Responsible, Sustainable, Impact, and, finally, Impact-only, where financial returns are non-existent.

Put simply, the first step as an ESG investor is to determine which point on the spectrum you would like to invest in before searching for the right financial product to fill your needs.

Why is it Important?

Besides offering investors a way to better align their portfolios with their values, ESG Investing has two other significant benefits: risk mitigation and overperformance.

Simply focusing on financially-related risks can lead to significant gaps in evaluating an investment’s overall risk. A typical example used in ESG training materials is the BP Deepwater Horizon oil spill in 2010. Leading up to the spill, BP had the worst safety record of all of its peers, with over 750 safety violations, while four of its largest competitors had less than 20 combined.

Unfortunately, ESG investing was only in its infancy at this time, and not enough investors were factoring in the risk of this poor safety record. BP’s share price still hasn’t recovered from its pre-spill high, resulting in devastating losses to shareholders, which may have been avoidable had they used an ESG lens to screen their investments. Other famous examples include Enron and Worldcom, two companies with seemingly strong financial performance. Many investors might have evaded substantial losses if more emphasis had been placed on ESG factors, such as governance.

By helping avoid these catastrophic events resulting in potentially devastating portfolio losses, investments with a higher ESG rating have seemingly outperformed, especially during the COVID-19 pandemic. In other words, ESG investors saw much less of a drop in their portfolio value than more traditional investors. During the massive COVID-19 selloff in early 2020, leading global ESG companies outperformed their peers with lower ESG scores by almost 7%.

How to Navigate ESG Investing?

As encouraging as the rise in ESG investing has been for the investing community, it has also brought on its own slew of problems. One of the most common examples is called “greenwashing,” where a company or investment manager provides a false impression of how green or environmentally friendly they or the companies they invest in are. Just because there is a picture of a wind turbine on the front of an ETF marketing document doesn’t mean that fund actually invests in anything to do with wind turbines.

In fact, they could still invest primarily in oil and gas, except they invest in the oil and gas companies that have the best ESG rating versus their peers. Essentially, investing in these higher-rated companies is good, but it’s the disconnect between what you are actually investing in versus what the marketing is portraying that is concerning. This misrepresentation has caught the attention of Canadian regulators and will likely lead to some positive changes that aim to make things more transparent.

Still, in the meantime, make sure to follow a fundamental rule every investor should follow: know what you are buying. Read the fund fact sheet, see what the ETF actually invests in and don’t let slick marketing get the best of you.

Similarly, as ESG investing is so new, no universal standards or enforceable regulations exist as they do for accounting. Some organizations have come up with their own. However, it will still take some time to consolidate into a single set of standards widely adopted by financial authorities. This discrepancy means you could see an investment with a good ESG score by one current standard but a poor score via another. The lack of consistency may confuse the majority of investors. Still, it also leads to immense opportunities for those willing to research and do their own due diligence. Taking the time to dig deeper and genuinely understand the ESG aspects of your potential investments could lead to you having the bragging rights the next time you compare your portfolio with your friends.

Opinions are those of the author and are not intended to provide investment, tax, accounting or legal advice. The information and opinions contained herein have been compiled from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and the author shall not be liable for any errors, omissions or delays in the content, or for any actions taken in reliance.