Summary: Robo-Advisors and DIY Investing

Exploring investing options outside traditional investment advisors – like robo-advisors or DIY investing – saves you a lot of money in fees while producing the same (or sometimes better) results. While the difference in fees between these options seems small, the compounding effects can actually help you retire years earlier and switching from a traditional investment advisor is not as scary as it seems.

When I turned 21, my parents gave me control of a $30,000 account from my Grandma. They told me I should set up an appointment with their investment advisor to invest the money. This sounded like a good idea, as I had no knowledge on investing. When I walked into the advisor’s office, she explained her plan to invest my money and the fees she charged, and in my naivety I just nodded. I couldn’t compare anything she told me to other potential investment options because I didn’t know there were other options. I assumed that the fees she charged were a fact of life. This could not have been further from the truth.

When I told a friend of mine about my plan to leave my money with my parent’s investment advisor he was horrified. He explained to me how I could save money by investing myself and reducing the fees, which would otherwise be charged by the investment advisor, and how that saved money compounds over time.

I was extremely hesitant to bail on my parents’ advisor because of my complete lack of investing knowledge. I was also dead set on not wanting to do any work with my investments, so in my mind the advisor’s fees were the price I would pay for not having to worry about my investments. Despite that, after only a few hours of research on DIY investing and robo-advisors, I was convinced to move the money from my parents’ investment advisor and go out on my own. The result has been an amazing sense of financial empowerment, which in turn has encouraged me to save more money and, contrary to what I initially thought, I still don’t have to do any work with my investments.

Why should I care about these seemingly small fees?

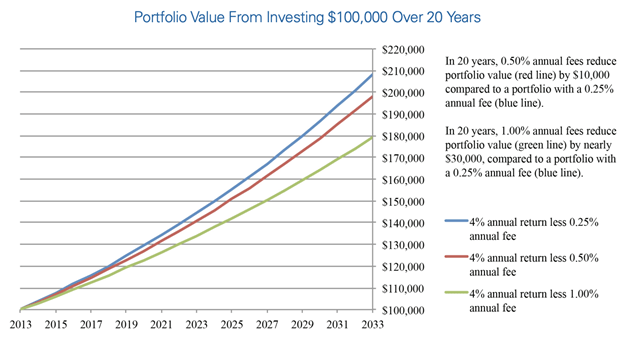

Investment advisors have many different types of fee structures. The structure my parents’ advisor charged is the most common: a percentage of the account’s yearly balance. For a traditional advisor this percentage ranges from 1%-2%. The seemingly small 2% on my $30,000 investment would have worked out to $600 per year. To me, this was a reasonable price to pay someone to handle my money. However, a critical piece of information that I was missing was the long-term effect of how this percentage compounds over time as my investments continue to grow. The SEC (Securities and Exchange Commission) has released a bulletin on the compounding effects of fees over time. They calculated that a $100,000 portfolio with a 0.25% annual fee ends up with $30,000 more than the same portfolio with a 1% fee over 20 years. When viewed in that light, the 2% fee that I was being charged doesn’t seem so small anymore.

I recommend checking out the bulletin for more helpful graphics and information. Another eye-opening statistic from NerdWallet’s head of investing and retirement points out that, for millennials saving for retirement, the difference between 0.5% and 1% in fees could mean the difference between retiring at 70 versus retiring at 73. Investing with rates of less than 0.5% is completely attainable by switching away from an investment advisor to a robo-advisor or DIY investing.

What are my investment options?

One important thing to realize when choosing where to invest is that traditional advisors, robo-advisors, and DIY investing all follow the same approach for how to invest your money, and the returns long term are roughly the same – provided that you’re not trying to time the market or buying and selling when you get scared (more on that in Timing the Markets vs. Time in the Markets and Why You (Probably) Shouldn’t Day Trade).

In some cases, actively managed funds, which are what your traditional investment advisor provides, underperform indexes so you could see better performance with DIY investing or robo-advisors. But to really maximize the chances of your investments doing the best they can over the long term, focus on the one thing you can control: the fees.

There are a number of options available that can reduce the fees charged by traditional advisors. The closest option to a traditional advisor is a robo-advisor. In Canada, popular robo-advisors are Wealthsimple and Questwealth (although Questwealth does have some human intervention). The management fees for balances under $100,000 for those two services are 0.5% and 0.25%, respectively. Getting started with these robo-advisors is as easy as getting started with a traditional advisor, and they generally allow an extremely hands-off approach by doing things like rebalancing your investments for you (rebalancing is buying or selling assets in your portfolio to maintain the original desired level of risk and asset allocation). You simply answer a few questions so they understand what your risk tolerance is and then they handle the rest.

Another option with even lower fees, which is slightly more hands-on than a robo-advisor is to do everything yourself using an online brokerage to buy whatever type of investments you’d like to purchase (ETF’s, mutual funds, stocks, bonds, etc.). In Canada, popular brokerages are Questrade or Wealthsimple Trade. You can find examples of model portfolios online that match your risk tolerance and then you can buy exactly what those portfolios tell you to buy. My favourite site for model portfolios is Canadian Couch Potato. When investing yourself you do have to take time every year to make sure you rebalance your accounts (more on that in this post).

Getting started with investing doesn’t have to be scary. You can take a completely hands-off approach with a significant reduction in fees by looking into robo-advisors or branching out on your own. Once you start and see how simple it is, the feeling of empowerment is amazing.

Are Traditional Investment Advisors Bad?

After understanding the possibilities for investing on your own you may be wondering if it is the beginning of the end for traditional investment advisors. This is not the case. Investment advisors provide a sometimes needed human point of contact, and in many cases serve as more than just investment managers. They can also provide planning, coaching and education for all things finance. For example if you’re planning for a child or you’re thinking about starting a business or quitting your job, a knowledgeable financial advisor can help you with these decisions whereas a robot cannot. That being said, if and when the time comes for me to enlist the services of a human investment advisor, the knowledge I have gained from investing myself will be invaluable in helping me ask the right questions so I can find an advisor that’s a good fit for me, rather than just blindly going with “mom and dad’s guy.”