Summary: Stock Market Returns

Do current events impact stock market returns? Contrary to popular belief, not really. There may be some impact to the markets in the short term, but long-term these events rarely have a significant impact.

My default stance on the stock market is optimism. I’d say this mindset is justified: the markets usually go up in the short-term, and they have always gone up in the long-term. Being bearish on the long-term prospects of the market feels akin to waiting for the Harlem Globetrotters to go on an extended losing streak.

That being said, a human tendency towards pessimism (fuelled by the news cycle) leads many to focus on the potential negative impact of current events, extrapolating the impact to stock market returns. While these events dominate headlines, their impact on stock market returns is far more nebulous.

Wars

Don’t turn to the stock market for a lesson on morality.

When wars break out, the market is weighing two uncertain futures: one in which the impact is small-scale and contained, and one where the conflict escalates to worst-case-scenario levels. Shocks related to invasions or escalations in conflict are natural, in the sense that they contribute incrementally to potential societal collapse. This is a reality in which stocks, cash, and ownership claims in general wouldn’t carry much value.

But inevitably the market rebounds from these short-term shocks, ultimately not having a major impact on long-term stock market returns. Even commodity markets, which are more vulnerable to the risks of armed conflict and supply disruptions, display incredible long-term resilience. Natural gas prices spiked to all-time highs following Russia’s invasion of Ukraine when the ability of millions of individuals in Western Europe to heat their homes came into question. Since peaking in August of 2022, natural gas prices have fallen by almost 80%. Situations like this often leave me amazed at how well global supply chains can adjust to upheaval.

Market reactions to conflicts are generally short-term and unpredictable. Their consideration should not be a key contribution to an investment strategy.

Which political party is in charge, and politics in general

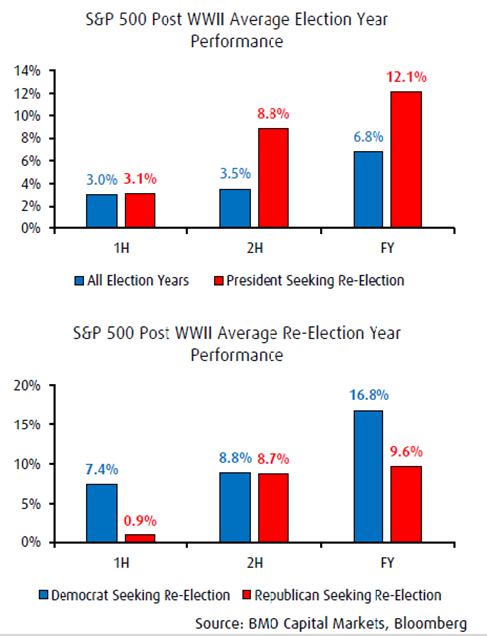

Election cycles get a lot of shine, particularly in election years like 2024. I’d say in general that politicians are given a little too much credit for the impact that they can have on stock market returns. One of the concerns with Donald Trump’s presidential campaign in 2016 was the impact that he as a political anomaly would have on the markets; this narrative shifted shortly after his election and the stock market rallied. People worry about election years but overall they have been fairly kind to investors:

The United States is consistently outranked by a number of developed countries in quality-of-life indicators tied to good governance, but its stock market has exhibited the strongest global growth, both in the short- and long-term.

Sound government sets guardrails for functioning capital markets, but beyond establishing an acceptable standard for commercial operations, their impact is limited. Public companies with operations in countries where rule of law is circumspect understandably trade at discounts. Just ask American enterprises operating in Cuba in the 1960s: when your property runs the risk of being seized by a revolutionary communist government, the investment case gets a little bit harder to justify. But once you hit qualifying standards for a democratically elected government, the nuance associated with which party is in charge doesn’t have much demonstrable market impact.

Whether stocks are currently cheap or expensive

Valuations are a component of a lot of investing strategies. When I first became interested in the markets, the first thing I’d look at was a stock’s price-to-earnings multiple. It just struck me as logical to buy stocks that were on sale and avoid ones that felt overpriced.

It turns out some stocks are cheap for a reason, and their earnings will fall to reflect their stock price. Alternatively, stocks that seem expensive will often grow into earnings multiples.

Within the broader market indices, valuations are usually above historical averages. This is because stocks trade at significant discounts during market corrections, dragging long-term averages down. Markets can trade at high multiples for long periods of time, generating high returns for investors; they can also trade down or sideways when the stocks are already cheap relative to long-term averages. Valuations are a component of investing, but they don’t tell the whole story.

Whether Mercury is in retrograde

I haven’t come across any sustainable investment strategies that devote a significant focus to astrology.

So what does drive stock market returns? Over time, it’s corporate earnings growth, plain and simple. Good companies that make money and continue as profitable businesses will see their share prices go up. They will look for new ways to innovate, increase productivity, and grow profits. In cases like this it helps to zoom out and take consideration of what the stock market really is: it’s the opportunity for normal people to take ownership stakes in companies and reap the benefits as their enterprise values increase.

Think big picture when it comes to stock market returns…

Most of the concerns that individual investors focus on are short-term in nature; despite the relative insignificance of short-term performance, it is the timeframe that gets most of the focus. In investing, somewhat paradoxically, it’s much easier to predict the long-term than the short-term.

For more insightful articles by Max, click out his full article summary by clicking here!

Opinions are those of the author and may not reflect those of BMO Private Investment Counsel Inc., and are not intended to provide investment, tax, accounting or legal advice. The information and opinions contained herein have been compiled from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the author nor BMO Private Investment Counsel Inc. shall be liable for any errors, omissions or delays in content, or for any actions taken in reliance. BMO Private Investment Counsel Inc. is a wholly-owned subsidiary of Bank of Montreal.