Research estimates that we make approximately 35,000 decisions on a daily basis. That number includes everything from small matters such as whether we hit snooze for another five minutes in the morning to big picture decisions such as will we choose to purchase a new house and relocate. Enrolling in a pension plan (multi-employer or otherwise) is one way to delegate many financial decisions to an outside professional whilst accruing a retirement nest egg.

Pension plans were originally designed to take the financial stress off employees after working for a number of years. This was mutually beneficial for the employers sponsoring the plans given that at inception many occupations were more strenuous on the body and worker productivity declined rapidly at older ages.

In modern times, life expectancy has grown dramatically and worker productivity does not have the same correlation with age as it once did. However, the majority of Canadians still plan for retirement; a time when their financial assets can support then so that they can live their lives without adherence to anyone else’s schedule or productivity metrics.

What is a Defined Benefit Pension Plan?

Defined benefit pension plans allow many Canadians to achieve retirement at a defined age without the concern over whether they will run out of funds in their retirement or not. In recent history as life expectancy continues to rise more employers have shied away from offering defined benefit pension plans due to potential for rising funding obligations on their part to satisfy the capital requirements of paying pensioners over a longer time span. Many of those employers have instead chosen to offer defined contribution pension plans.

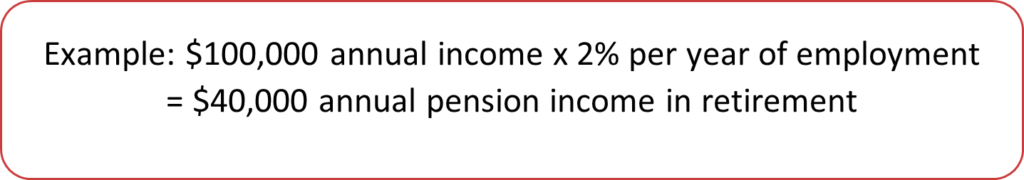

Defined benefit pension plans are formulaic in nature, the pension provides a defined benefit based on a certain prescribed calculation, usually the formula multiplies earnings by length of employment, and then multiplied by a certain percentage. The output is what a retiree from the defined benefit pension plan would receive on an annual basis at retirement age.

What is a Multi-Employer Pension Plan?

A multi-employer pension plan simply takes the pre-existing pension plan model and allows multiple employers to access the plan in order to share costs with one another, as setting up a pension plan for a small group of employees can be prohibitively costly.

Specifically in the case of professionally incorporated individuals such as physicians with a medical corporation, or lawyers with a legal corporation, it has historically not been a viable option to utilize defined benefit pension plans given the corporations often have only one or two employees, which would be the physicians themselves.

Practically, in the case of physicians or lawyers what this means is that multiple unrelated individuals can enroll in the defined benefit pension plan offered by a financial institution, the professional corporation pays the employer’s share of the funding obligation and the lawyer or physician pays the employee’s share of the funding obligation. These contributions are usually made on an annual basis and the result is the professional will receive a retirement income stream according to the defined benefit formula once they choose to retire.

Who benefits from a Defined Benefit Pension?

A defined benefit pension plan can be a valuable asset in one’s retirement portfolio given its security. Unlike the stock or bond markets where capital gains, dividends, and interest income are variable, with a defined benefit pension plan the amount of income produced is knowable in advance.

Pension programs also allow for unique financial planning opportunities such as income splitting with a spouse in retirement, an expense to the professional corporation during working years, and an alternative investment within the professional’s overall financial portfolio.

Given the complex nature of professionally incorporated individual’s financial picture and the wide variety of savings options available it is worthwhile to consult with a financial planner in order to ascertain which programs may be right for the individual.