Summary: Why Don’t Schools Teach Basic Finance?

Although personal finances are important in your every day life, school doesn’t teach basic finance. You graduate high school and you’re forced to navigate the world of finance on your own – the good, bad and the ugly. So why don’t schools teach basic finance?

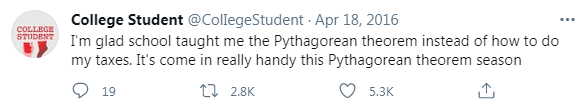

I always think of this Tweet around tax time. A functional democracy is dependent on the government’s ability to collect tax revenue, but our educational system doesn’t touch on the role that individual income tax filings play in this process. The solution to ignorance is education. This begs the question: why don’t we combat financial ignorance in schools?

1. Resistant to Change

Newton’s first law is applicable to more than just physics. Educators and the education system are much like the rest of society: resistant to change. The core of the education system has remained largely unchanged since public schools were first established: a functional knowledge of reading, writing, and mathematics, coupled with lessons on history and government to help students contextualize their place in the world.

The unfortunate repercussion of this is a school curriculum that hasn’t evolved with the times. Our financial system is perpetually growing more complex through globalization, digitization, and an ever-evolving legal system and tax code. Beyond this, saving for retirement has become more of an individual responsibility than it ever was in the past. Now the majority of pension plans are defined contribution instead of defined benefit. Who is telling these workers how to invest their pensions to meet their retirement goals? Proper investment management can unlock huge amounts of financial potential (to read more on Personal Finance topics, click here).

2. Teachers Lack the Expertise

Current educators can’t be expected to have subject matter expertise on material they were never taught. If the school curriculum were updated to include financial literacy, we would need to hire new teachers. Due to budget and time constraints, other areas of the curriculum would have to be cut, which may lead to a loss of jobs. In the face of these challenges, the easier alternative is to maintain the status quo.

3. Entrenched Interests

Greed is a core competency of humanity; it keeps the cogs of the capitalist machine turning. In order to sate our desire for more material goods, we have artificially expanded our balance sheets through debt to the point that the citizens of most developed economies are now enveloped in consumer debt crises.

The sad reality is that corporations, even governments, make more money when people don’t know what to do with their finances. We buy new cars when our old ones operate just fine. We carry credit card balances because paying the minimum today leaves more money to spend. We miss out on income tax deductions because we don’t know any better.

Difficult, but Necessary

The fact that rudimentary finance and investing subjects aren’t touched upon in standard school curricula is what allows me to publish articles. If I instead wrote articles about the Pythagorean Theorem, there would likely be no audience because (1) it isn’t actionable information for the vast majority of society; and (2) they already taught it to us in school.

An effort to promote financial literacy would be one of the most progressive agenda items that any government could pursue. The benefits would be concentrated among lower income individuals who can’t afford professional financial services. It may not be an easy transition but society would greatly benefit from heightened financial literacy (to learn more about Investing and the power of proper planning, click here).

Opinions are those of the author and may not reflect those of BMO Private Investment Counsel Inc., and are not intended to provide investment, tax, accounting or legal advice. The information and opinions contained herein have been compiled from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the author nor BMO Private Investment Counsel Inc. shall be liable for any errors, omissions or delays in content, or for any actions taken in reliance. BMO Private Investment Counsel Inc. is a wholly-owned subsidiary of Bank of Montreal.