A lot has been said about passive investing and active investing over the past number of years. Proponents of passive investing suggest that it is difficult to outperform the market average, whereas opponents suggest active investment management can either produce superior returns or reduce portfolio risk. Target date funds are more common place in passive investing strategies.

I believe both arguments have merit however, if an investor adopts one strategy or the other, it’s imperative they understand why; otherwise their ability to gauge the success of their chosen strategy is non-existent. As such, I’m encouraging retirement savers to revisit their passively managed target-date funds.

What are Target Date Funds?

A target date fund is an investment portfolio that aims to shift from predominantly growth assets such as stocks into more conservative assets such as bonds, as the predetermined “target date” approaches. For example, a Target 2035 Fund may have had 60% stocks and 40% bonds in 2025. By 2030 it may have 50% stocks, 50% bonds, and upon arrival of the target date in 2035 it would have transitioned into 40% stocks and 60% bonds.

Why Should You Consider a Review of Your Target Date Funds?

Why should this warrant a review when this type of portfolio is designed to be a set and forget investment approach? Over the forthcoming years, a passively managed approach to this investment strategy will force investors to sell their stocks to purchase bonds with near all-time low interest rates, drastically hampering the portfolio’s future performance. As interest rates fell, bond prices have increased, meaning investors will be paying a premium price for bonds purchased while the interest rates designed to fund a retirement income stream will not deliver the same type of income they once did. Currently, long-term Canadian government bonds yield around 3%, compared to yields of approximately 2% a few years ago. This means that the income generated from the bond portion of a portfolio has improved somewhat, but remains relatively low by historical standards. At earlier lows, Canadians would have needed to invest 50% more to generate the same income as they could have in 2014, when yields were closer to 3%. While rates have since rebounded, fixed income returns are still modest compared to previous decades.

There is also a risk present when purchasing bonds at elevated prices and low yields, whereby short of negative interest rates, rates have little room to fall further. The reverse effect is then observed, whereby rising interest rates cause the price of bonds to fall – bonds which the investor may have already purchased.

A Hypothetical Illustration

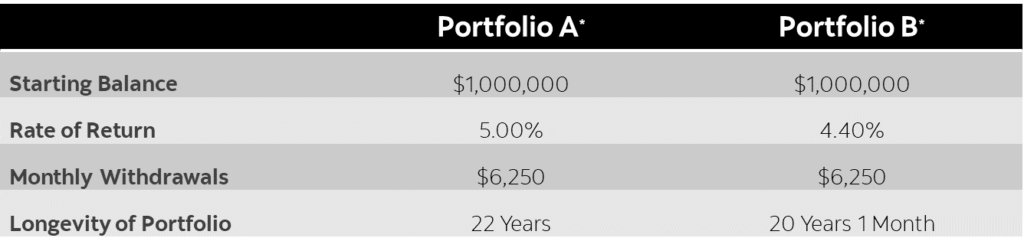

Assuming equal returns on the stock portion of portfolios, a portfolio that delivers a 1% lower return on the bond allocation will run out sooner. To illustrate this, if a historical portfolio of 40% stocks and 60% bonds returned 5%, a portfolio wherein the 60% bond portion underperformed by 1% going forward would return just 4.4%. If a retiree started with $1,000,000, and drew $75,000 a year in equal monthly portions, it would deplete in 22 years, assuming a consistent 5% rate of return. Comparatively, that same retiree would deplete their capital almost two years sooner, after just 20 years, should their portfolio only return 4.4%.

What are the Alternatives?

Pension funds and effective money managers have managed declining interest rates for many years by investing with an active approach to manufacture a return that will suit the investor’s cash flow needs while staying within defined risk parameters. Such solutions have presented themselves in the form of alternative investing, including but not limited to hedge funds, structured products, and real estate.

As a wealth advisor, I believe it is essential that portfolios are designed based on each investor’s unique needs through a systematic, disciplined investment process that combines asset allocation and security selection. One size fits all solutions such as target-date portfolios may be convenient, however as they are designed for a broad audience, they are not optimal on an individualized level.